Marketing Mix Modeling is not a new concept; it’s been around since the middle of the 20th century and was popularized when Kraft used it to track the relationship between television ads on different networks and Jell-O sales. But MMM has (obviously) become a lot bigger, a lot more intricate – and a lot more important.

What is Marketing Mix Modeling?

What’s the difference between MMM and MTA?

Wait, what about Media Mix Modeling? Is that the same thing as Marketing Mix Modeling? What makes them different?

“Media” and “Marketing” are often used interchangeably when talking about MMM. But there’s an important distinction.

Media Mix Modeling analyzes the effectiveness of paid media efforts. Media Mix Modeling looks at elements like ad size, ad platform, channel distribution – all the factors that affect paid media performance.

Marketing Mix Modeling, however, is a broader term that includes marketing efforts that you don’t have to pay for. Marketing Mix Modeling factors in paid media, but also takes into account:

- Non-paid actions like email sends

- External events like price changes

- Word-of-mouth marketing from influencers

Because it incorporates everything, Marketing Mix Modeling can paint a fuller picture of how all marketing efforts are working in concert.

How is Pickaxe MIX different from other MMM models?

Mix is smart, and updates daily.

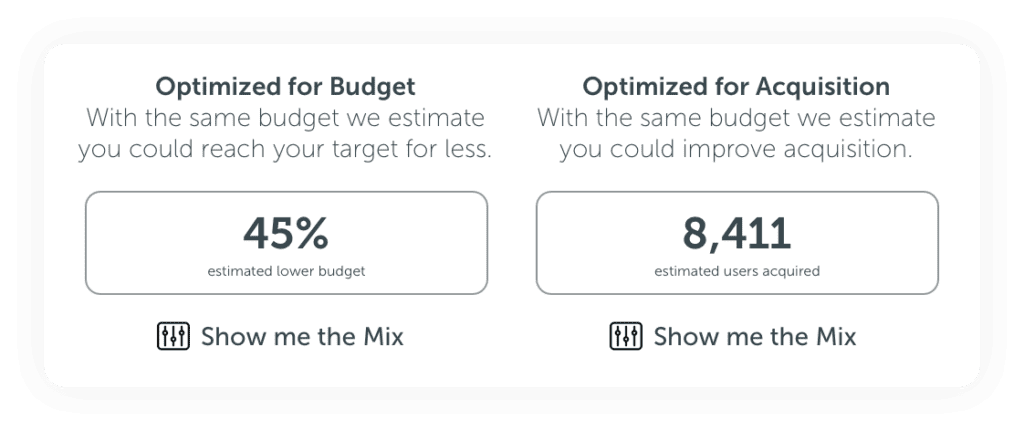

Pickaxe MIX is a tool we’ve built that looks at all of the patterns in your spending, and identifies the moments where changes in patterns have influenced sales. Based on that information, it creates a cost-per-action (CPA) value for each incremental dollar spent on each network. And then (unlike a traditional MMM model that can take forever to update) Mix adjusts CPA over time with AI-driven analysis. It’s a souped-up, supercharged version of MMM that uses modern data pipelines and AI to give you a view of your data that’s proactive, comprehensive, and intuitive.

Mix is customizable.

Every marketing team has different needs, and a unique way that they summarize their information. Mix allows marketers to create queries and define channels in a way that matches the way their business uses each channel. Mix is customizable, so it can think how your marketing team thinks.

Mix goes beyond just paid media, and consider earned and owned as well.

Lots of marketing efforts aren’t reflected in the paid marketing budget. For example, social media: while ad spend on promoting a social post might be part of the budget, a viral post or an active social team isn’t. Mix can be configured to take these non-elements into consideration when calculating a CPA.

Mix can also factor in email blasts, talk show appearances, co-promotions, influencers, and other marketing efforts.

And Mix can also be customized for other key business strategies!

Our customers have used Mix to model out price changes, paywall settings, new reality show seasons, and new product launches.

Mix even factors in events outside of marketing efforts.

Lots of things can influence engagement that have nothing to do with touchpoints. Inflation, election spending, and Q4 ad prices rising - all of these things can affect whether your customers purchase! Things like seasonality and historic changes are baked into Mix, but when something big and unusual happens (like Covid in 2020), Mix can alert you immediately to the unexpected performance and provide quickly adjusted insights.

For example: A global streaming service that offers a lot of reality programming noticed a massive spike in sign-ups in May of 2023. At first, this might seem like a fluke. But if you’re a Bravo-head, and you remember the drama around Vanderpump Rules’ Tom Sandoval, you might also remember that the Vanderpump reunion episodes aired that month. This is a major external factor that might throw off CPA in a traditional model, but Mix is able to integrate it and adjust calculations accordingly.

How can Media Mix Modeling work in practice?

Here’s an example:

A global streaming service was facing a problem – they were using multiple attribution methods, and none of them were comprehensive.

For instance, their Web Attribution data and their Ad Network data were telling dramatically different stories about customer engagement. Their Mobile & Cross device attribution was limited to the users that could be tracked by their customer data platform, which included less than half of their customers. And none of these attribution methods took their “above the line” spending into consideration.

So after creating a new attribution methodology to better understand their data, they used MMM to compare their Ad Network numbers with their newly attributed data. We then helped them examine the Life Time Value (LTV) for all their users to figure out which campaigns and channels had attracted the highest (and lowest) value customers. And once that was done, we used Pickaxe MIX to figure out the impact of their ad spend on all these channels.